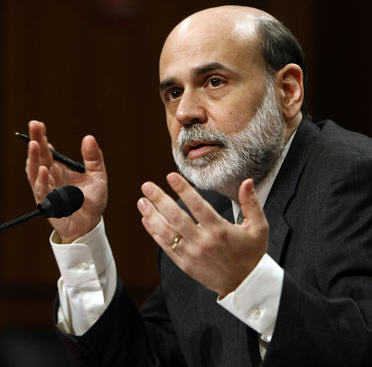

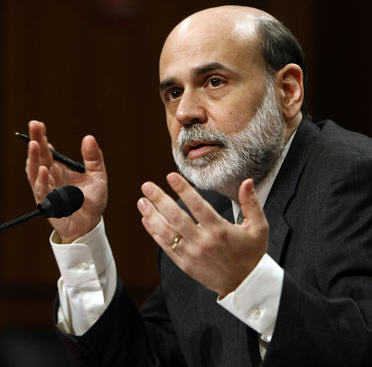

They say "actions speak louder than words." But last week, words had a big impact on the market, especially those by Fed Chairman Ben Bernanke. What did he say, and what was the impact on home loan rates? Read on for details.

Last week, Bernanke essentially made some downbeat and economically depressing comments, saying that "the economy is still producing at levels well below its potential." Remember that weak or negative economic news and comments normally hurt Stocks and helps Bonds, as investors will move money from Stocks to what they see as safer investments like Bonds (including Mortgage Backed Securities, upon which home loan rates are based). And that’s part of what we saw happen last week: Bonds and home loan rates improved on these negative economic comments, while Stocks weakened.

But that’s not all Bernanke said last week. He also spoke about inflation, saying, "FOMC participants currently see the recent increase in inflation as transitory and expect inflation to remain subdued in the medium term." Why is this significant? Inflation is the arch enemy of Bonds and home loan rates, because it erodes the value of the fixed return provided by a Bond, which causes home loan rates to rise. This means that Bonds, and therefore home loan rates, typically worsen at the first sign of inflation. But Bernanke playing the role of inflation dove last week (an inflation "dove" believes inflation will have a minimal impact on the economy, the opposite of an inflation "hawk") also helped Bonds and home loan rates improve.

So what does this mean for the markets and home loan rates in the short- and long-term? Here’s a visual that will help explain things. Imagine a child playing with a yo-yo riding on an escalator. If Bond prices are the yo-yo, you can see how they would be moving up and down like the action of the yo-yo in the short term. And this is what we are seeing right now: Bond prices and home loan rates are moving day to day in somewhat volatile fashion but continue to move in an improving trend. But just like the child will reach the end of the escalator, Bonds and home loan rates will eventually reach the end of their improving trend... and when they do they will likely worsen quickly, as history attests.

The bottom line is that home loan rates still remain near some of the best levels we’ve seen this year, and it’s important to take advantage of these levels while they remain. If you have been thinking about purchasing or refinancing a home, call or email me to learn more about why now is a great time to benefit from today’s historically low rates. Or forward this newsletter on to someone you know who may benefit.

No comments:

Post a Comment